-

Programs

- Close

- Ways to Give

- About

-

Contact Us

- Close

-

Donate Today

- Close

- Online

- By Mail or Phone

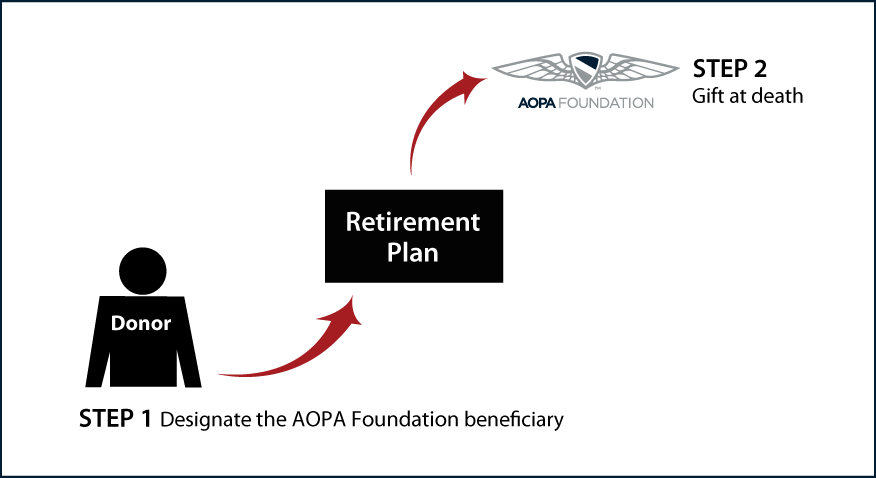

Special note: Call or e-mail us to tell us of your intent, and we will assist you with the details of the transfer.

Request an eBrochure

Which Gift Is Right for You?

Contact Us

|

Becky Johnston |

The AOPA Foundation |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer